Table of Content

Penalty APR, jacking up your interest rate as excessive as 30% in some circumstances. When you're on a 0% interval or have a low ongoing price, being bumped up to a penalty fee may be disastrous. If punctuality is an issue for you, look into a card's penalty insurance policies .

That interest will proceed to accrue until you’re capable of pay your stability off in full. Our payoff calculator can help you see how long it'll take you to pay off your bank card debt and the way much you’ll pay in interest. If you suspect you’ll want to carry a stability after your intro APR interval ends, this card’s low-end APR could prevent a ton in the long run. The card also carries an affordable balance transfer fee of simply 3% (or $10, whichever is greater) and doesn’t cost a penalty rate, so you won’t be punished with the next APR should you battle to pay on time. The best zero-interest bank cards tout long promotional APR periods, often between 14 to 21 months and might save you lots of or thousands of dollars in interest. But before you sign up for one, ensure you know what you’re moving into.

Hsbc Rewards+ Mastercard

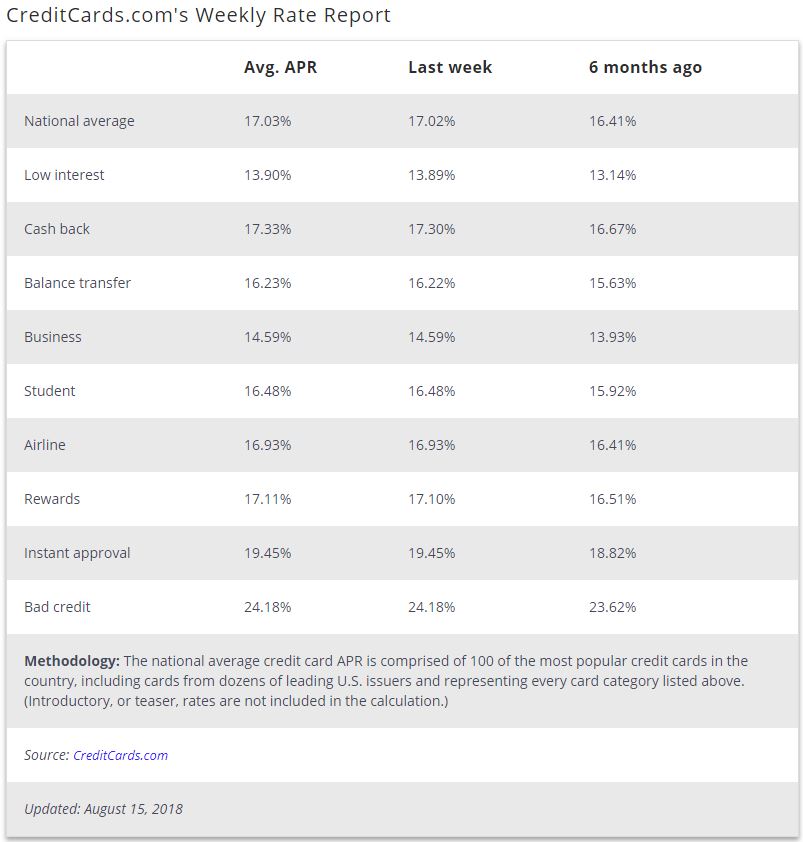

Traditional bank cards often provide a reasonably excessive APR within the area of 24%. Such a high APR is commonly given to a borrower with an average or unhealthy mortgage. After the end of this period, curiosity begins to accrue on the balance that remains after the end of the billing cycle. To avoid paying interest, the borrower must pay the mortgage debt month-to-month. To compare mortgage offers, the borrower is really helpful to show to open Internet sources that have articles with comparative tables. Such tables take into account the entire above key elements of different proposals.

A 5% ($5 minimum) payment applies if the balance switch is accomplished after four months of account opening. If you don’t transfer a qualifying balance inside 120 days from account opening, you’ll fail to qualify for the intro rate and the 3% intro balance transfer payment (then as a lot as 5%; min $5). It is feasible to negotiate a lower interest rate on your credit card and it can’t harm to name your issuer and ask. If you've a history of well timed funds and use your credit responsibly, the issuer could offer a decrease fee to maintain your small business. The worst-case situation is they are saying “no” and you can try again as quickly as you’ve spent a while increase your credit score. Some might even include sign-up bonuses, which might help offset costs even further.

Can Apr Be Equal To Or Lower Than The Curiosity Rate?

Before deciding on a card, understanding your payoff timeline may impact your determination. Some have longer promotional periods than others, which can affect your payoff timeline when you hope to pay as little curiosity as possible. Keep in thoughts there are some introductory APR offers that solely apply to purchases and will not embrace stability transfers. Once you could have your payoff goal in thoughts, you presumably can choose the card finest suited for your timeline. With terms ranging from 12 to 60 months and regular APR of 14.99% to 29.99%, cardholders on the decrease end will see advantages of this fastened monthly payment schedule quite shortly.

We problem inaccurate unfavorable objects with the bureaus and your collectors. PeriodA 0% APR period represents how lengthy the issuer will let you keep a stability without accumulating curiosity. Forbes Advisor created extra star rankings so that you simply can see the most effective card for particular wants. This card shines for this use, however total the star scores may differ when in comparability with other playing cards. We’ve rounded up some of our prime picks when it comes to 0% APR cards that can help you resolve which card is best for you.

Section 1: Best No Interest Bank Card Presents For All Sorts Of Customers

His recommendation to others with seemingly insurmountable debt is to likewise look into debt consolidation and different financial instruments that can assist. And whereas analysts say many U.S. shoppers remain in good monetary shape thanks largely to low unemployment, the debt scenario is rising dire. Editorial and user-generated content on this web page just isn't supplied, commissioned, reviewed, permitted or in any other case endorsed by any issuer. For account opening, the borrower should be 18 years old and be a citizen or permanent resident of the United States.

You can get extra value, so far as perks and rewards go, with different cash again playing cards. This card lacks a rewards program and there’s no welcome provide. Our mission is to supply readers with accurate and unbiased info, and we've editorial requirements in place to make certain that happens.

Globetrotters and even infrequent budget travelers will love the flexibleness and overall worth of this low-interest journey rewards card. For a limited time, earn 5 ThankYou® Points per $1 spent at restaurants up to $6,000 in the first 12 months and 1 ThankYou® Point per $1 spent thereafter. 5X For a limited time, earn 5 ThankYou® Points per $1 spent at restaurants as much as $6,000 in the first 12 months and 1 ThankYou® Point per $1 spent thereafter.

So add it all up, and American society now owes $66,000,000,000,000 of debt! The national debt is $31 trillion when together with Social Security’s and Medicare’s unfunded liabilities. That’s getting close to 150% of our national gross domestic product of $22 trillion. Caitlyn is a contract writer from the Cincinnati space with shoppers ranging from digital advertising companies, insurance/finance companies, and healthcare organizations to journey and know-how blogs. She loves studying, touring, and camping—and hanging together with her canines Coco and Hamilton.

The every day price of curiosity in your purchase is decided by dividing your card’s APR—in this example 20%— by 365 to seek out the daily price of curiosity after which multiplying that quantity by your stability. Most cards advertise a spread of APRs, together with your exact interest rate being determined by your creditworthiness or a company’s danger evaluation on your ability to pay. This is why a 0% APR is commonly listed as an “introductory” fee. Once your promotional period is over, your rate of interest will return to the standard fee and you're no longer eligible at 0% APR. Behavior-based repricing is a rise or lower in a credit card customer's rate of interest based mostly on the shopper's compensation exercise.

There isn't any rewards structure on this card, so its long-term worth isn’t high. Discover will match the amount of cash back you obtain on the finish of your first yr. Information in regards to the Capital One VentureOne Rewards Credit Card has been collected independently by Select and has not been reviewed or supplied by the issuer of the card prior to publication. A $500 minimal safety deposit is required to entry credit, which is greater than the common $200.

Your interest rate might be acknowledged as an APR, or “annual share fee.” This is the yearly price of borrowing cash. In addition to its lengthy intro interval and low interest rates, cost-conscious households will appreciate the money back charges at U.S. supermarkets and U.S. gasoline stations. If you’re notably loyal to a minimal of one airline or a sure alliance, you’re most likely higher off going with a provider co-branded credit card.

Earn $200 cash back after you spend $1,500 on purchases within the first 6 months of account opening. This card earns 5% cash back on journey booked via Chase; 3% money back at restaurants and drugstores; and 1.5% on other purchases. Offers a 0% intro APR interval that may probably strategy two years, should you make your month-to-month funds on time. It's essential to pay off any transferred debt or lingering new purchase balances before the intro 0% APR interval ends. And when you have a retailer card, you would be hit with a invoice for all of the interest you accrued for the explanation that date you made your buy or switch .

However, some rewards playing cards with 0% curiosity periods do cost an annual fee; whether it is worth paying is determined by how a lot you anticipate to earn in rewards. And should you spend a minimal of $61 per week at the supermarket, you might be better off paying the annual charge on that card since you'll come out ahead with the higher rewards price. A no-interest credit card is a great software for financing new purchases, however you should watch out how you employ one.

No comments:

Post a Comment